ADA Price Prediction: Navigating Volatility With $1 in Sight

#ADA

ADA Price Prediction

ADA Technical Analysis: Short-Term Bearish, But Signs of Resilience

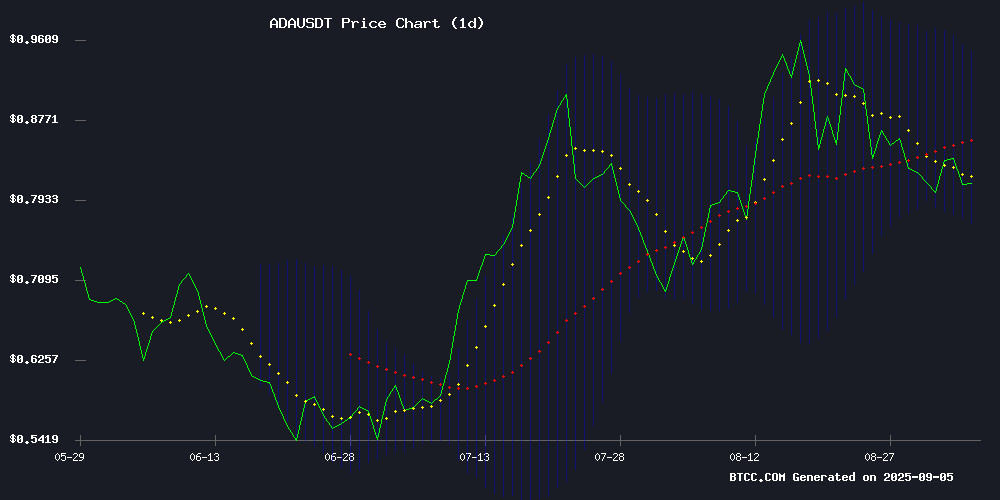

ADA is currently trading at $0.8149, below its 20-day moving average of $0.85938, indicating short-term bearish pressure. The MACD shows a bullish crossover (0.042894 vs 0.015832 signal line), suggesting potential upward momentum. Bollinger Bands show ADA NEAR the lower band ($0.769805), which could indicate an oversold condition.

"The technical picture shows ADA at a critical juncture," says BTCC analyst Mia. "While below the 20MA suggests caution, the MACD divergence and Bollinger Band position hint at possible accumulation near these levels."

Mixed Signals for ADA: Whale Selling vs. Positive Audit Results

Cardano faces conflicting signals: whale wallets dumped 30M ADA during recent volatility, yet an independent audit cleared the project of misconduct allegations with 99.7% voucher redemption verified.

"The whale activity creates near-term headwinds," notes BTCC's Mia, "but the audit resolution removes a major overhang. Sentiment at 5-month lows despite price resilience suggests potential for mean reversion."

Factors Influencing ADA’s Price

Cardano (ADA) Faces Mixed Sentiment Amid Market Volatility

Cardano's native token ADA, the tenth-largest cryptocurrency by market capitalization, has endured a turbulent week, declining 6% over the past seven days despite a year-to-date gain of 159%. Market sentiment remains divided, with some analysts pointing to bearish signals while others highlight potential bullish reversals.

Santiment data reveals a notable shift in trader sentiment, with ADA holders turning increasingly bearish—a contrarian indicator that has historically preceded price rebounds. Technical analysts are split, with one camp identifying an inverted head-and-shoulders pattern suggesting upward momentum, while others note ADA's underperformance relative to alternative cryptocurrencies during bear markets.

Cardano Whales Dump 30 Million ADA Amid $1 Price Volatility

Cardano faces heightened volatility as large holders offload 30 million ADA following its breach of the $1 resistance level. The sell-off, flagged by analyst Ali Martinez, has sparked debate over whether this marks a distribution phase or a temporary shakeout before renewed upside.

On-chain data reveals conflicting signals. While whale exits typically precede short-term pullbacks, ADA maintains a 9% monthly gain with strong technical support at its 200-day EMA. The token's ascending price channel suggests a potential breakout toward $2 if current support holds.

Market participants are watching the $1 psychological level closely. Cardano has historically rebounded from similar whale-driven selloffs, making this a critical inflection point for medium-term price direction.

Cardano Audit Clears Founder of Misconduct, Confirms 99.7% ADA Voucher Redemption

Cardano's internal investigation has dismissed allegations of financial misconduct, revealing that 99.7% of ADA tokens sold under its voucher program were successfully redeemed. The joint audit, conducted by Input Output Global, law firm McDermott Will & Emery, and accounting firm BDO, found no basis for claims of misappropriation.

Unclaimed ADA tokens were allocated to cardano Development Holdings for grants and community initiatives. The report details the redemption timeline and the secure framework used for voucher distribution, with all transactions recorded on-chain.

Earlier this year, founder Charles Hoskinson faced accusations of manipulating 318 million ADA (worth $619 million) during the 2021 Allegra hard fork. The audit findings fulfill Hoskinson's promise to address these allegations transparently.

Cardano Sentiment Hits 5-Month Low Despite ADA Price Resilience

Cardano's retail investor sentiment has plummeted to its most bearish level in five months, according to on-chain analytics firm Santiment. The shift comes despite ADA's 5% rebound from late-August lows, highlighting a growing divergence between price action and market psychology.

Santiment's sentiment chart reveals three distinct phases: an early-August greed spike (12.8:1 bullish ratio), mid-August fear (2.0:1 ratio), and the current extreme bearish reading (1.5:1). The firm notes this contrarian signal often precedes rallies as 'key stakeholders accumulate' during retail capitulation.

The data suggests ADA's recovery may have room to run. As Santiment observed: 'Prices typically MOVE opposite the crowd's expectations.' The altcoin's ability to hold key support while sentiment deteriorates could set the stage for a more sustained rebound.

Cardano Cleared in ADA Redemption Controversy as Audit Discredits Allegations

Cardano's ADA voucher redemption program has been vindicated by an independent forensic audit, putting to rest weeks of contentious allegations. Input Output Global (IOG) underwent rigorous scrutiny from law firm McDermott Will & Emery and audit giant BDO, who found zero evidence supporting claims of insider theft or systemic flaws.

The investigation spanned tens of thousands of documents, blockchain forensics, and 18 witness interviews. Charles Hoskinson, Cardano's founder, publicly welcomed the findings with characteristic defiance, anticipating retractions from critics. Five Core accusations—including claims of manipulated blockchain upgrades and key deletions—were systematically dismantled.

How High Will ADA Price Go?

Based on current technicals and market sentiment, ADA could see the following scenarios:

| Timeframe | Bull Case | Base Case | Bear Case |

|---|---|---|---|

| 1-2 weeks | $0.92 (upper Bollinger) | $0.85 (20MA) | $0.77 (lower Bollinger) |

| 1 month | $1.00 (psychological level) | $0.88 | $0.70 |

"The $1 level remains key," emphasizes Mia. "Whale selling pressure needs to subside, but the cleared audit and oversold conditions create favorable risk/reward near current levels."

- Technical indicators show oversold conditions with bullish MACD divergence

- Market sentiment at 5-month lows despite price holding key support

- Fundamental overhang removed via positive audit results